A surge of optimism is shaking the copyright market, with Bitcoin prices soaring to new heights. This recent rally is fueled by growing regulatory clarity in key jurisdictions around the world. Governments are read more finally taking action frameworks to regulate cryptocurrencies, which has brought much-needed stability. Bullish traders are piling in, anticipating further advancement in the coming months. The future of Bitcoin holds immense potential as regulations provide a much-needed structure for long-term success.

DeFi's Next Frontier: Exploding Growth in Decentralized Lending and Borrowing

The decentralized finance (DeFi) ecosystem is expanding rapidly/growing at an unprecedented pace/exploding in popularity, and one of its most promising/exciting/dynamic sectors is decentralized lending and borrowing. This innovative/revolutionary/disruptive space allows users to access/obtain/acquire loans and lend/deposit/provide funds directly to each other without the need for traditional financial institutions/centralized intermediaries/bank involvement. The benefits of this peer-to-peer/decentralized/open-source system are manifold/numerous/extensive, including lower interest rates/reduced fees/increased transparency.

Decentralized lending platforms leverage smart contracts/blockchain technology/cryptographic protocols to automate/facilitate/enable the entire lending and borrowing process, streamlining/simplifying/enhancing the experience for users. These platforms offer a wide range/diverse selection/comprehensive array of loan products/financial instruments/investment opportunities, catering to a broad spectrum/varied pool/large number of borrowers and lenders.

- For example/Illustratively speaking/Specifically, popular platforms such as Aave, Compound, and MakerDAO allow users to borrow/lend/trade cryptocurrencies like Ethereum, Bitcoin, and stablecoins.

- As the DeFi space continues to evolve/mature/progress, decentralized lending and borrowing are poised to play an even more central/integral/crucial role in shaping the future of finance.

Argentina Embraces copyright: New Rules Spark Investment Boom

Argentina has witnessed a remarkable surge in copyright investment following the implementation of its latest regulations. These move by the government has been a significant step towards embracing blockchain technology and creating a more inclusive financial system. As a result, Argentinians are flocking to copyright exchanges and purchasing digital assets with increasing enthusiasm. The promise for higher returns and safety against the depreciating Argentine peso is motivating this unprecedented growth.

NFTs Reshape Digital Ownership: A Comprehensive Guide to Metaverse Assets

The meteoric explosion of NFTs has fundamentally transformed the concept of digital ownership, paving the way for a new era of virtual treasures. In this in-depth guide, we delve into the fascinating world of metaverse assets and explore how NFTs enable unprecedented control over these digital entitles. From exclusive virtual art to evolving in-game items, NFTs are redefining the way we interact with and own digital artifacts within the metaverse.

- NFTs: The Cornerstone of Digital Ownership

- Understanding Metaverse Assets: A Diverse Landscape

- The Value Proposition: Why NFTs Matter in the Metaverse

- Navigating the NFT Marketplace: Tips and Best Practices

- The Future of Metaverse Assets: Trends and Predictions

Web3: A Blockchain-Powered Future for the Internet

The web is on the cusp of a radical evolution thanks to Web3. This cutting-edge movement leverages blockchain infrastructure to decentralize control, empowering users and promoting a more open online environment. Picture a landscape where people own their data, interact directly with each other, and contribute the growth of online platforms. Web3 is redefining the way we interact online, creating new possibilities for creativity.

- A primary advantage of Web3 is its distributed nature. This means that data and applications are not controlled by any single entity, eliminating the risk of censorship and strengthening user protection.

- Another, Web3 supports new models for ownership through digital assets. These individual digital assets can represent anything from music to in-game items, giving users ownership over their virtual .

- Finally, Web3 is propelling the growth of decentralized applications (copyright). These software run on a public network, bypassing the need for conventional hosts and providing greater transparency.

Strategic Bitcoin Reserves: Institutional Adoption Driving Market Stability

The integration of institutional investors into the Bitcoin market is accelerating a wave of strategic reserves. These institutions, ranging from hedge funds to corporations, are recognizing Bitcoin's strength as a diversifier against inflation. By holding significant holdings of Bitcoin, they are smoothing the market and mitigating price volatility. This trend points to a growing confidence in Bitcoin's long-term durability as a store of value.

Jaleel White Then & Now!

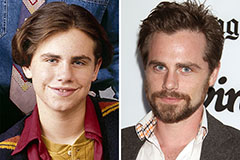

Jaleel White Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now!